The knowledge sharing…

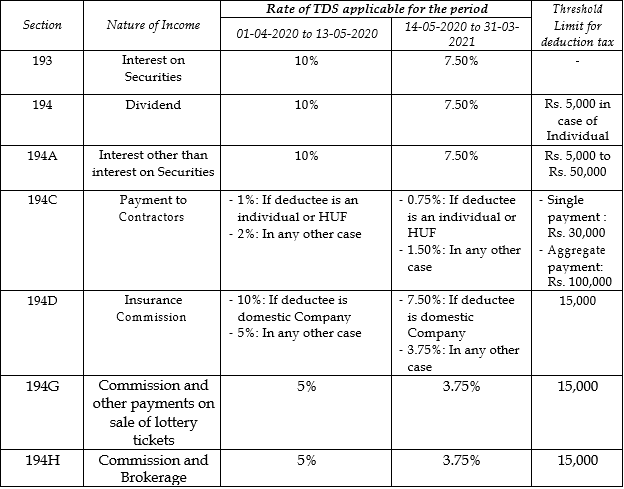

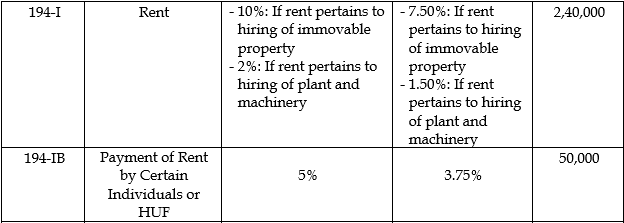

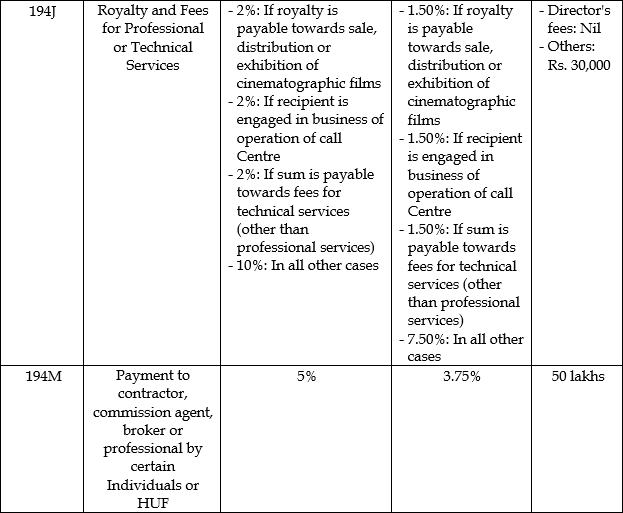

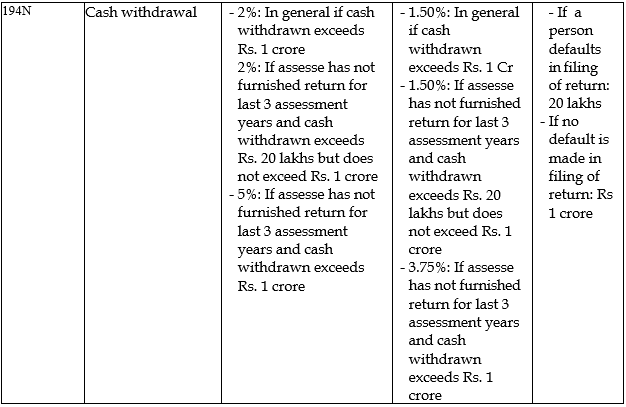

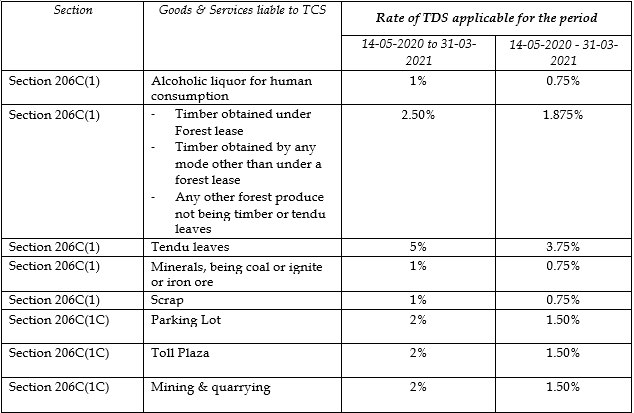

In the press conference held on May 13, 2020 the Finance Minister, Smt. Nirmala Sitharaman, announced that the rates of TDS/TCS in respect of specified payments/receipts shall be reduced by 25%. This reduced rate of TDS (Tax deducted at source) and TCS (Tax collected at source) will be available for payment for contract, professional fees, interest, rent, dividend, commission and brokerage income. This reduction will come into force from 14-05-2020 to 31-03-2021. This relief shall not be available for salaried taxpayers.

The government also extended the due date of all income tax returns for FY 2019-20 from 31 July 2020 and 31 October 2020 to 30 November 2020.

The arrangements, under which the concessional paces of TDS/TCS will be accessible, will be known when an Ordinance is proclaimed in such manner. As the decreased rates will come in power from 14-05-2020, we have counted the provisional paces of TDS/TCS in the beneath the table.